Nissan faces tough decisions amid production cuts and tariff woes

The automaker plans to cut U.S. production by 100,000 vehicles while grappling with potential tariffs on Mexican imports.

Nissan is facing significant challenges as it navigates production cuts and the looming threat of import tariffs. The Japanese automaker announced plans to slash U.S. vehicle production by 100,000 units in the current fiscal year, affecting key models such as the Frontier, Rogue, Pathfinder, and Infiniti QX60, Bloomberg reported.

This decision comes as the company struggles with declining profitability, a bloated vehicle inventory, and heightened political pressures that could worsen its financial troubles. Nissan

Related: Cheap cars could be getting very expensive

Production cuts signal tough times

Nissan’s plans to scale back production at its Mississippi and Tennessee plants reflect a broader strategy to align with declining market demand. A company spokesperson said that Nissan will continue to evaluate production forecasts to maintain “healthy supply and inventory levels.”

These cuts are a continuation of cost-saving measures announced last month, which included a 20% production reduction and the elimination of 9,000 jobs globally. Analysts suggest the move could stabilize Nissan’s inventory challenges in the long term but will likely strain near-term revenues.

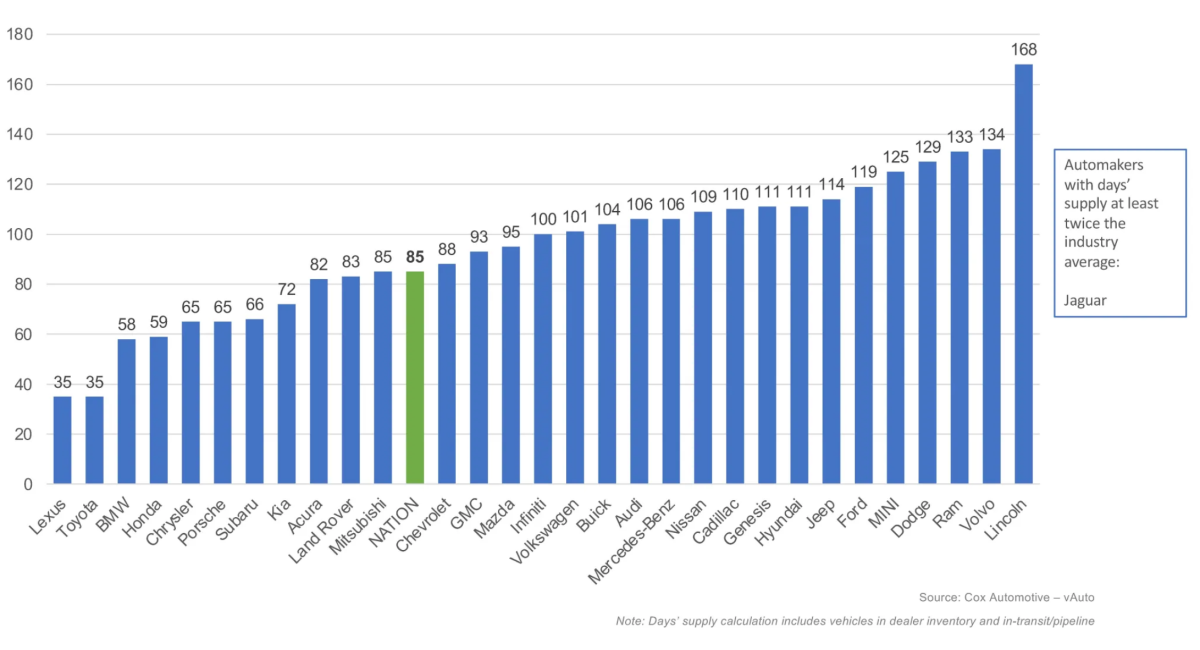

Across the automotive market, the average supply for new vehicle inventory sat at 85 days, according to the latest data from Cox Automotive. Nissan’s inventory is well above the industry average, with 109 days of supply.

Tariff threat adds pressure

Compounding Nissan’s struggles is the potential for new U.S. tariffs on imports from Mexico, where the company builds several models and engines. President-elect Donald Trump has proposed a 25% tariff on Mexican and Canadian goods, citing immigration and drug trafficking concerns.

The tariff could disrupt Nissan’s supply chain and raise production costs, further squeezing profits. The automaker already lowered its full-year operating income guidance by 70% earlier this month, and additional tariffs could deepen the financial hit.

Nissan builds both the Sentra and Versa models in Mexico. Currently, the 2025 Sentra has a starting MSRP of $21,590. If Nissan were to pass on the added costs of a 25% tariff to consumers, the same base model Sentra could cost close to $27,000—a troubling prospect for a company already struggling to move inventory.

Related: Toyota and Subaru sued over engine issues in GR86 and BRZ

What’s next for Nissan?

Nissan’s troubles have sparked speculation about its long-term strategy. Reports suggest the company is seeking a new anchor investor to reduce reliance on Renault SA, its primary shareholder. Potential buyers could include a financial institution or even rival automaker Honda.

While production cuts may seem dire, some analysts believe they are necessary. “The production cuts may appear positive in the long term, given any delay in cutting production also leads to problems including the higher cost of selling inventory vehicles,” said Tatsuo Yoshida, senior auto analyst at Bloomberg Intelligence.

Related: UK rethinks EV mandate amid industry challenges

Final thoughts

With U.S. consumer demand potentially buoyed by lower interest rates, Nissan’s ability to weather this storm will depend on navigating production challenges, trade policy uncertainties, and reinvigorating its vehicle lineup. In the meantime, it’s safe to say Nissan is in for a tough ride.