Don’t like your car dealer? Be careful what you wish for

The changing state of car buying has an unintended consequence

Given that EV manufacturers Tesla, Rivian, Polestar, and Lucid sell their vehicles directly to consumers, it's little surprise that Sony Honda Mobility plans to follow suit.

The new venture between the two Japanese corporate giants plans to sell their upcoming Afeela 1 electric vehicle directly to consumers as well, rather than use a traditional dealer network. Sony Honda Mobility

Honda and Acura dealers are far from thrilled, especially since the Afeela 1 will be built at a Honda factory in Ohio. To add insult to injury, vehicle service will be handled by Crash Champions collision repair centers nationwide rather than Honda or Acura dealers.

Related: eBay aims to make online car sales easier with Caramel

The reaction from the National Automobile Dealers Association (NADA) was predictable.

"Honda should understand that any misguided attempt to bypass or undercut its U.S. dealers will be challenged in statehouses and courthouses across the country—with NADA’s full support," said NADA President and CEO Mike Stanton.

VW will likely join Honda and Sony in those lawsuits

Volkswagen Group is also planning to sell its new Scout electric SUV directly to consumers. American VW dealers are predictably upset, as the new Scouts are the type of vehicle they’ve been asking headquarters to build for years, if not decades. Scout Motors

The decision also led to the California New Car Dealers Association (CNCDA) sending a cease-and-desist letter late last year to VW and Scout Motors, stating that since Scout is a VW affiliate, the German automaker may not compete against its own franchises under California law.

It was merely the opening salvo.

Dealers will fight the automaker on a state-by-state basis as dealer franchise laws are state-regulated. Existing automakers are required by those laws to sell their new vehicles through their existing franchised dealers, which the automakers don’t own.

However, the established sales model seems increasingly archaic as consumers become accustomed to direct-to-consumer sales models, such as Rivian's, Lucid's, or Tesla's, who are allowed to sell their vehicles directly to consumers as they have no current sales network.

Related: Every minivan you can buy in America in 2025

The online onslaught began decades ago

If any company started online automotive retailing, it’s Dealer.com, founded in 1998 to help auto dealers manage and sell their inventory. The platform would grow to include software for F&I and CRM and provide the software and support for their consumer-facing websites. By the onset of the Pandemic, the company held a 60% market share among new car dealer websites and more than 30 OEM-branded sites. Larry Printz

Their software allows customers to handle just about every step in buying a car online without stepping into the showroom. When retailers were shut down in 2020 due to the pandemic's onslaught, consumers began becoming more comfortable handling much of the car-buying experience outside of a showroom.

Existing dealers are increasingly comfortable adopting this sales model, as long as they get a cut of the action.

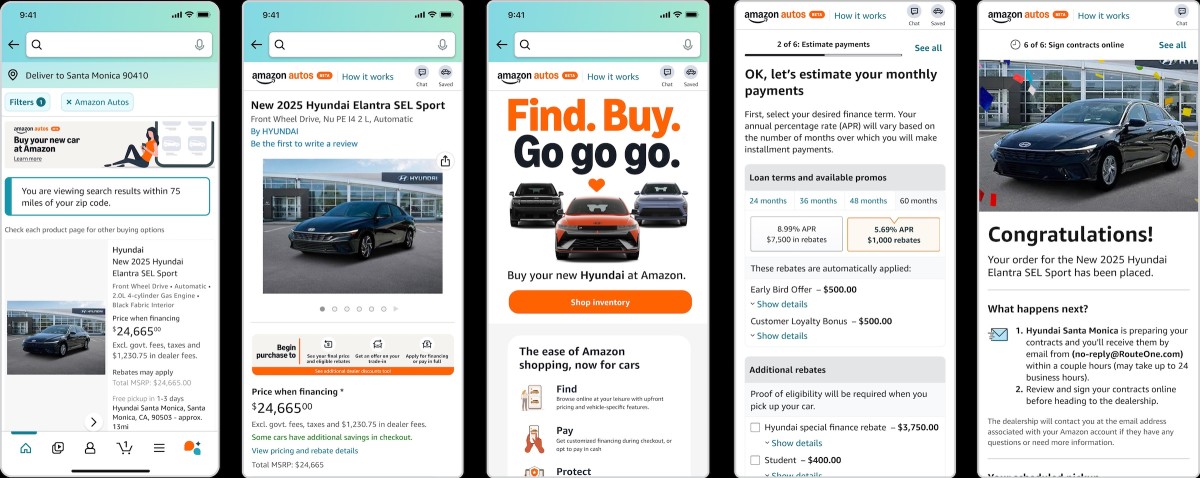

One such company is FordDirect, a joint venture between Ford Motor Company and Lincoln and Ford dealerships that allows customers to purchase vehicles online through a preferred local dealer. Another is Hyundai, which is selling its vehicles through Amazon Autos. Customers can shop for, finance, and choose their new ride online and pick it up at their local dealer. Hyundai

Related: Consumer Reports picked a widely panned EV as its worst car of 2024

Direct sales aren’t always the answer

Direct sales aren’t always a panacea. Consider Tesla, where getting your car serviced can take weeks, according to online reports. Then there’s EV startup Fisker, which filed for bankruptcy protection in June 2024. Like other EV startups, it used a direct sales model, but as sales foundered in January 2024, it turned to a traditional dealership model. It was too little, too late.

Neophyte Vietnamese EV automaker VinFast Auto sells cars directly to consumers and through dealers. VinFast currently has 18 dealers in California, Connecticut, Florida, Kansas, Kentucky, North Carolina, New York, and Texas, with more to come.

However, larger automakers have tried direct sales, notably the Ford Retail Network. Created by Ford Motor Company in 1998, it invested in Ford dealerships in Oklahoma City, Tulsa, Okla., Salt Lake City, San Diego, and Rochester, N.Y. The stores were set up with large inventories, no-haggle pricing, and non-commissioned sales staff. VinFast

As you might expect, it enraged nearby dealers, who feared factory-owned stores would receive preferential treatment. In the end, Ford’s efforts failed, reinforcing a key car dealer argument that while automakers may be good manufacturers, they aren’t good service providers or retailers.

Final thoughts

Yet the changing nature of automotive retailing and service has unintended results.

With the need for pricey technology investments as EVs become more mainstream, smaller dealers are increasingly selling out to larger ones. According to Kerrigan Advisors, a dealership selling consultancy, more than 544 franchises were sold in the first three-quarters of 2024, a record high.

Consolidation among larger dealers is expected to help them provide the sales and services that original equipment manufacturers (OEMs) desire. This also enables both automakers and dealers to maintain leaner inventory levels, which can drive up prices as dealers face lower carrying costs. For automakers, this situation reduces the need to discount vehicles to clear out inventory.

Empty new car lots during the Pandemic and EV makers’ built-to-order business model are making consumers more comfortable with ordering cars at full list price, but the unintended result is clear: prices will continue to climb.

Related: BMW X5 origins: The untold story behind the brand's first SUV