Chinese EVs are coming to the U.S., tariffs or no tariffs

The U.S. automotive market remains an untapped market for Chinese automakers but that may soon come to an end

After more than two decades of planning, preparation, and execution in their local market, Chinese electric vehicle (EV) manufacturers have launched an assault on the outside world.

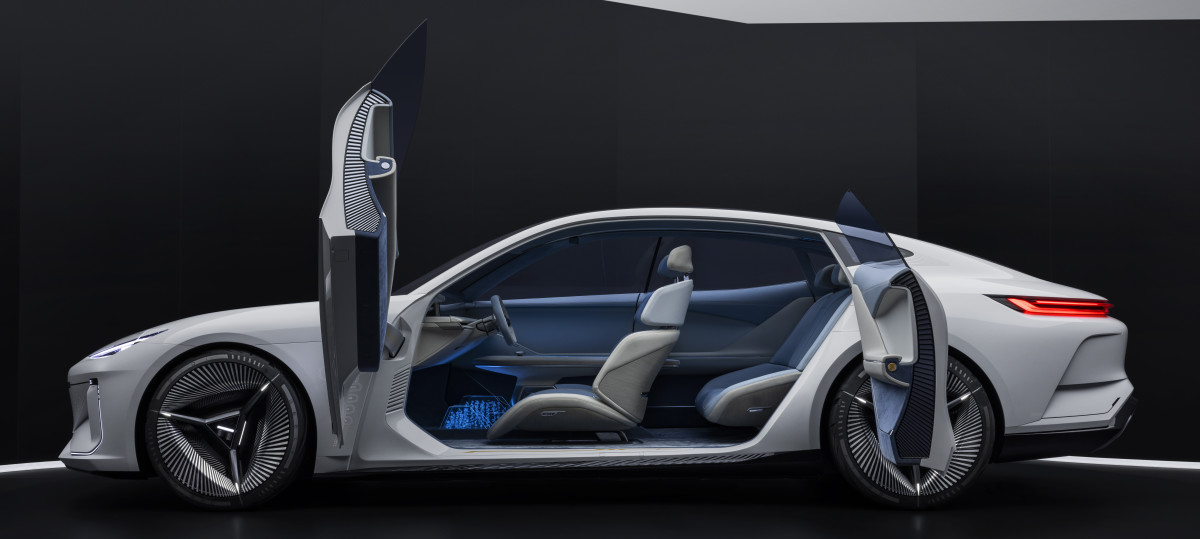

With a huge excess of production capacity, their logical next step is to export these well-developed and professionally-made electric vehicles worldwide. The vehicles listed below reflect some of the Chinese EVs that we think would likely sell here based on style or price.

Related: The shocking truth behind China’s EV dominance and America’s uphill battle

Chinese EVs are already hitting export markets

Chinese EVs have already established beachheads in several major markets. These include Europe, Latin America, and nearby Mexico (which is a party to the USMCA trade agreement). Mexico has become a large market for Chinese internal combustion engine (ICE) vehicles, as well as their EVs, which meet Mexican safety standards and can be sold at competitive prices in that market.

Could the U.S. be China's next market?

It would seem that the next domino to fall might be the U.S. market, in which affordability issues have depressed sales for consumers of lesser means with average transaction prices lingering around $50,000. This situation would make low-and-medium-priced Chinese EVs a natural fit, filling price points that other manufacturers have abandoned.

Not so fast, you say! The U.S. has placed 102.5% tariffs on imported Chinese EVs! This has been done not only to protect the U.S.-based automakers, who simply cannot compete with the 20+-year head start the Chinese EV industry has. It has also been done on grounds of national security, to keep the Chinese EVs’ sensors and cameras from supposedly surveilling every inch of our country on behalf of the Chinese Communist Party.

What can Chinese EV manufacturers do to get around the tariffs?

Chinese manufacturers can take a cue from the Japanese automakers, who also mounted an export blitz during the 1980s. Small, fuel-efficient Japanese cars became very popular during the 1973 gas crisis. This surge in Japanese car imports led to protectionist pressures that resulted in their industry’s agreement to Voluntary Export Restraints, which were estimated to have been equivalent to a 60% tariff.

To meet the growing demand for Japanese vehicles in our huge market (and to get around the export restraints), Japanese manufacturers began to build their own automaking plants in the United States.

Honda was the first, with Accord production starting in 1982 and Civics rolling off the line four years after that. Nissan followed suit in 1983, with the Toyota/GM joint venture NUMMI plant producing cars in 1985. The Mitsubishi/Chrysler joint venture Diamond-Star, Toyota’s first solo plant, and the Subaru/Isuzu joint venture were all set up in the late 1980s. Japanese suppliers also set up shop here to provide these factories with parts.

Related: Rivian and VW team up to take on the electric future

Chinese EVs will need to have a high percentage of U.S. content

While the U.S. automaking industry is none too eager to see Chinese EV plants on U.S. soil, the incoming Trump administration has stated that these manufacturers are welcome to build vehicles in the U.S. with U.S. workers. Individual states will offer generous incentives for the manufacturing jobs these factories will provide.

There will likely be a minimum U.S.-based content requirement, which will necessitate that the battery packs be built here, not imported from China. This will provide openings for suppliers like CATL, the major Chinese battery manufacturer, to build U.S. facilities. There could also be battery mineral content requirements demanding that the lithium and cobalt be sourced from U.S. or otherwise “friendly” mineral producers.

What about the national security concerns?

As for the national security issue, the U.S. could require Chinese manufacturers’ connected vehicles to link to a U.S.-based cloud with a “back door” that allows our security agencies to review, analyze, and delete any sensitive data being collected. Another option is to simply remove these systems from lower-end vehicles to maintain their entry-level affordability.

What happens with pricing if these Chinese EVs are made in the U.S.?

As you might expect, prices could increase if Chinese EVs are made in the U.S. with U.S.-sourced materials and parts. They will also have to meet U.S. safety standards. The Chinese have already significantly raised the prices of their exported vehicles when compared to their home-market prices so whether or not an additional hike ensues remains an unknown.

For example, the €12,947 ($13,543) BYD Dolphin sells for €35,490 ($37,124) in the Netherlands. The €17,939 ($18,765) SAIC MG4 goes for €39,990 ($41,831) in Germany. Some of this could be additional safety equipment, but the Chinese definitely don’t want to undersell the local vehicles by too large a margin.

This prudent tactic should keep any European import tariffs down to a tolerable level and unlike the U.S., countries like Germany export a large percentage of their production, leading them to a more balanced solution vis-a-vis China.

Final thoughts

With a new administration taking office in January, a lot of the issues around Chinese EVs are still up in the air. At this point, it is highly unlikely that American consumers will be driving Chinese EVs anytime soon - unless Chinese manufacturers commit to building them here. If they do, expect to see some serious competition for both domestic and international makes from a country they have never gone up against.