Tiny cars, big trend, why Americans are downsizing at record rates

Rising costs are pushing drivers back to small cars, but will the trend continue?

American drivers may have reached peak big-vehicle love. Car buyers across the U.S. have gravitated toward larger, roomier vehicles over recent years, pushing automakers to shift production focus to more profitable trucks, SUVs, and big sedans.

However, that trend is beginning to shift. Economic pressures, including stubbornly high car prices and sticky interest rates, are forcing buyers to rethink their priorities. For a growing number of Americans, the question is no longer about how big a vehicle can be but how well it can fit their budget.

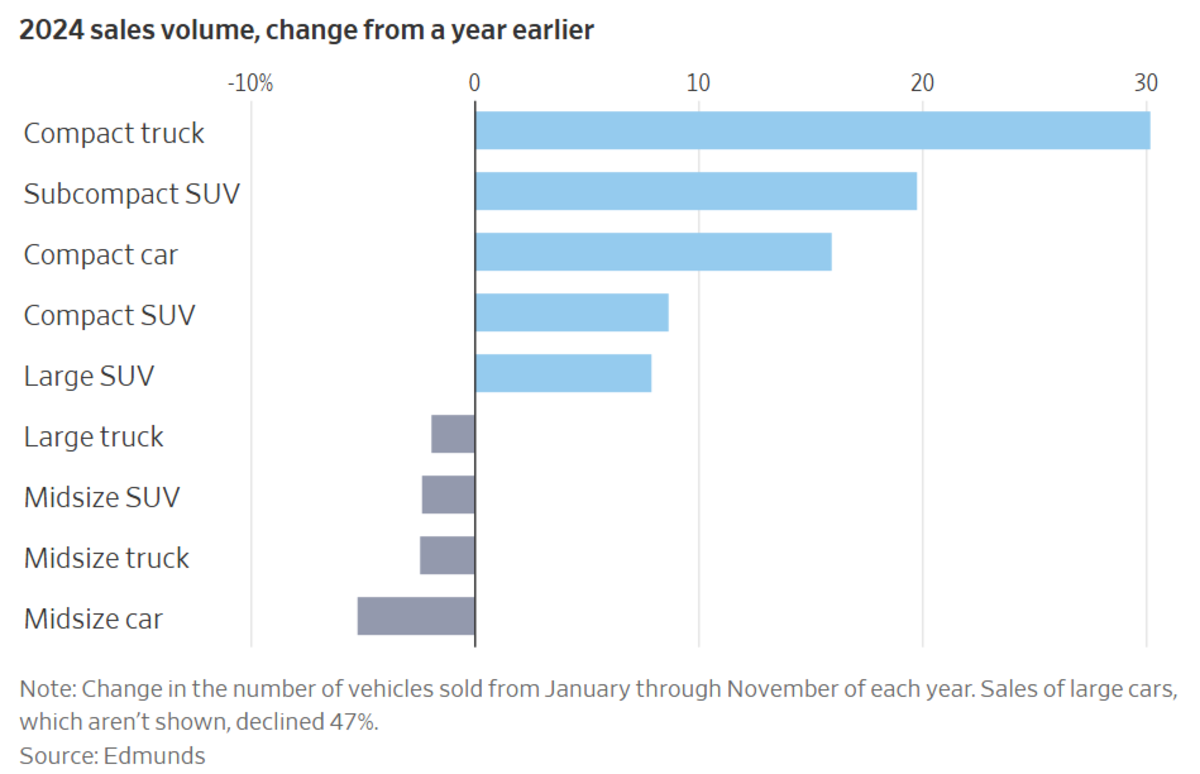

According to new data from Edmunds, that shift has created an unexpected renaissance for smaller cars and compact SUVs. After years of declining sales, these vehicles are making a comeback, offering an affordable alternative for cost-conscious buyers.

Related: Mazda is selling more cars than ever—all without an EV in sight

The costs of car ownership have skyrocketed

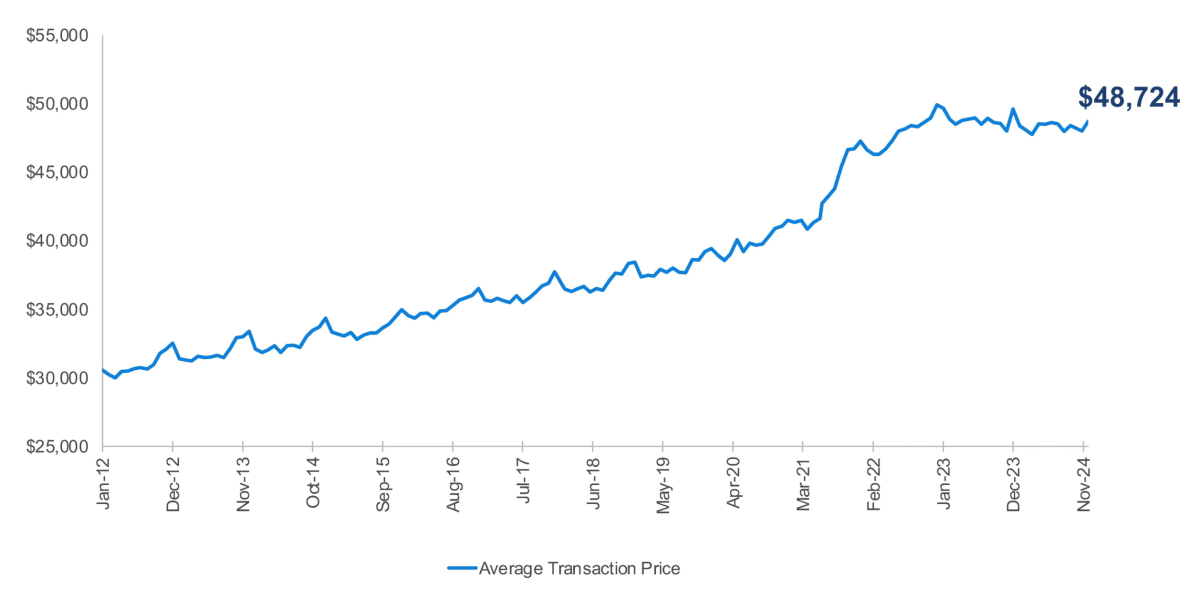

According to Cox Automotive, the average selling price of a new car exceeded $48,000 in November 2024. Financing, insurance premiums, and repair costs have also ballooned, stretching household budgets to their limits. For many buyers, a $48,000 midsize SUV or a $76,000 large SUV is simply out of reach. Cox Automotive

“They need the functionality that the vehicle has, but they just need to buy the smaller size,” said Charles Chesbrough, a senior economist at Cox Automotive. “It fits into their wallet.”

The price difference between a smaller model and a larger one can be staggering. Edmunds reports that the average price paid for a compact SUV this year was $29,000, compared to $48,000 for a midsize SUV. That $19,000 gap can make a world of difference for cost-conscious buyers.

Related: Tesla leads 2024 recall list, find out which automakers followed

Small cars make a big comeback

Sales of smaller vehicles have surged this year, with compact cars like the Honda Civic and Nissan Sentra posting gains of over 23% through November. During the same period, sales of compact and subcompact SUVs also increased by 11.5%. These vehicles now account for 27% of U.S. sales, a significant jump from 22% before the pandemic. Wall Street Journal

Asian automakers, including Toyota, Honda, and Mazda, are leading the charge. These brands have long dominated the market for compact sedans and SUVs, offering models with starting prices under $25,000. Notably, the Mazda3 and Honda HR-V have posted double-digit sales increases this year, while Chevrolet’s budget-friendly Trax SUV saw an 89% sales jump.

Related: Honda CEO's surprising confession about Nissan merger

Why buyers are downsizing

The shift toward smaller cars isn’t just about price; it’s also about practicality. Compact and subcompact SUVs offer a higher riding position, better fuel economy, and advanced features like large media screens and safety tech, all at a lower price point. For families who don’t need the extra hauling capacity of a large SUV, these vehicles offer plenty of the same perks without the drawbacks.

Automakers have been phasing out affordable sedan and hatchback options in favor of downsized SUVs. According to Edmunds, the number of new cars priced under $25,000 has plummeted from 45 models in 2019 to just 11 this year. In response, buyers looking for affordability have embraced petite SUVs as a substitute, whether by choice or necessity.

This renewed interest in smaller vehicles may also be tied to broader lifestyle changes. With more Americans living in urban or suburban areas where parking space is limited, smaller cars and SUVs often prove more practical for daily use. These vehicles provide enough utility for most activities while being easier to maneuver and park.

Related: 2025 Chevy Traverse goes upscale, drops base LS model adds High Country

A challenge for U.S. automakers

While Asian brands benefit from the growing interest in smaller vehicles, Detroit’s Big Three face challenges. American automakers have largely abandoned sedans and compact cars, focusing instead on larger trucks and SUVs. This strategy, while profitable during the era of cheap gasoline, has left them with fewer options for budget-conscious buyers. Chevrolet

General Motors has found some success with the Chevrolet Trax, which starts at about $20,000. However, many dealerships report a lack of inventory to meet the demand for affordable vehicles.

Adam Lee, chairman of Lee Auto Malls in Maine, said he frequently sees large trucks and SUVs sit on the lot longer as customers look for more affordable options. Lee said it is unfortunate that so many automakers have cut the most economical vehicles in their lineups. “They’re like a herd of sheep,” Lee said of the automakers. “They all follow each other off the cliff.”

Related: 2025 GMC Terrain sees a $1,300 price hike thanks to a costlier base trim

Will the trend continue?

Whether this downsizing trend continues depends on broader economic factors. Elevated interest rates could stabilize, making larger vehicles more accessible. Yet, proposed tariffs on goods made in Mexico and Canada—where many affordable cars are produced—could further drive up prices, solidifying the demand for smaller vehicles.

Of course, the sticker price isn’t the only cost associated with car ownership. Frugal consumers will likely gravitate towards smaller, more affordable models that are cheaper to maintain and run.

Related: These bizarre Nissan concepts will amaze you

Final thoughts

The trend toward smaller cars marks a significant change in the American auto market, but it’s not clear if the change is a cultural shift or simply a fiscal necessity. Regardless, the availability of increasingly in-demand small cars could have big consequences for automakers over the coming years.

With younger buyers now entering the market, companies that can offer entry-level vehicles may build stronger brand loyalty. Meanwhile, those without competitive small car options risk losing out on this critical demographic.

For automakers, the message is clear: offering smaller, budget-friendly options isn’t just about staying competitive—it’s about meeting the needs of a changing consumer landscape. By doing so, they can ensure their place in a market increasingly defined by practicality and affordability.

Related: U.S. Green Beret blows up Cybertruck outside Trump Tower in possible terror attack