EV sales in Europe are growing—with one big Tesla-sized exception

New data shows that European EV sales have declined this year, but one big outlier appears to be dragging the rest of the group down.

2024 has been a rough year for electric vehicle (EV) sales. Consumer interest in all-electric vehicles has waned in the United States and Europe, while a wave of EV interest among Chinese consumers has been almost wholly captured by domestic manufacturers. That’s the story we’ve seen so far, anyway.

Now, new data from the European Automobile Manufacturers’ Association (ACEA) suggests that the picture of EV demand in Europe might not be so bleak after all. Across Europe, the number of new EVs registered so far in 2024 has declined by about 1.4% compared to the same time last year. But, Autoblog analysis shows that the apparent decline is not as widespread as previously thought.

Related: Hyundai is pouring money into struggling China business

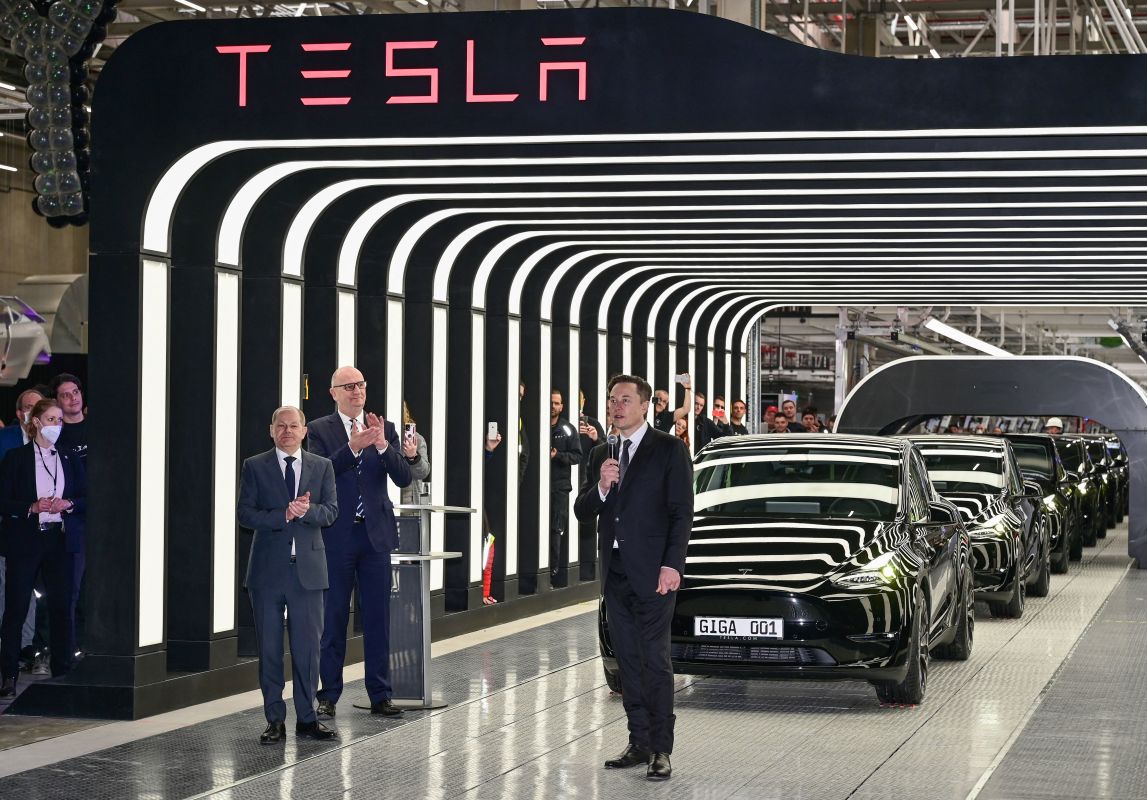

A Tesla-sized outlier in Europe's sales figures

Poor sales of Tesla vehicles across Europe have single-handedly driven overall EV growth into negative territory this year. Through November, the automaker has sold 283,000 vehicles in Europe, a sharp 13.7% decline from the same time last year.

View the original article to see embedded media.

Excluding Tesla from overall EV sales in Europe, ACEA data shows that electric vehicle registrations have actually grown 1.3% this year, more than double the overall market average of 0.6%. That’s a promising sign for most automakers—and a concerning one for Tesla.

To try and reverse the trend, Tesla has begun offering more direct discounts to customers across Europe, including a year of free Supercharging to anyone in Europe who purchases a Tesla before the end of the quarter. In Germany, where EV sales have been hit particularly hard, the automaker is offering €6,000 ($6,234) discounts on new Model Y vehicles.

Related: Meet the man who sold Kendrick Lamar his Buick GNX

Where EVs win and lose across Europe

Although EV sales are performing relatively well across Europe this year, the picture isn’t so simple from one country to another.

View the original article to see embedded media.

Among nations where EV sales have grown this year, the United Kingdom and Denmark account for over half of the nearly 150,000 additional EVs registered in 2024. Yet, even in these leading countries, Tesla struggled to drive sales, reporting a 14% decline this year, according to data from EU-EVs.

The picture is far worse in Germany. EV sales in Europe’s largest economy have nose-dived by over a quarter this year. Tesla’s poor performance in Germany—reporting a 47% drop in sales—certainly hasn’t helped that figure, but declining demand has affected other automakers as well. Even Volkswagen, Germany’s largest employer, has seen EV sales drop over 20% in its home country this year.

Related: Ford secures $9.63 billion federal loan for U.S. battery plants

A bad problem made worse

Tesla’s problems don’t appear to be getting much better either. Last month, the automaker reported a 28% drop in sales across Europe compared to last November, suggesting that the company’s sales gap from 2023 is getting worse, not better.

View the original article to see embedded media.

Aging models like the Model 3 and Model Y are struggling to compete with newer, more advanced rivals. Even the Model 3’s 2023 refresh can’t hide the fact that its design dates back to 2017. Tesla

Competition is also heating up, with German luxury brands and Chinese automakers making serious inroads in Europe. Meanwhile, Tesla’s price cuts, once a key sales driver, are losing their effectiveness as more EV options flood the market. Without fresher models, Tesla risks losing ground in a rapidly evolving industry.

Related: Why Honda is Going ALL IN on Fuel Cell Tech

Final thoughts

Tesla’s decline in Europe serves as a reminder that market dominance is never guaranteed, especially in a sector as volatile as EVs. While overall EV sales in Europe show signs of resilience, Tesla’s struggles make it clear that once cutting-edge tech can quickly become commonplace in the market. Aging models and fierce competition from both established brands and newer entrants are eroding its once-commanding position. Tesla

Still, the broader growth in EV sales—excluding Tesla—offers a glimpse of the sector’s potential. Automakers investing in diverse lineups and competitive pricing appear to be capturing the interest of European consumers, even in a challenging economic climate.

For Tesla, the road ahead will require more than discounts and refreshed designs. It will need bold new strategies and products to remain a leader in a market that it once ruled.